Real Estate Investing

Services

Individual Tax Services

Business Tax Services

Additional Services

Investing in real estate continues to be one of the best ways to build wealth and cut taxes. Benefits include the ability to recover the cost of income-producing property through depreciation, the use 1031 exchanges to defer profits from real estate investments, and borrow against real estate equity to make additional investments or for other purposes.

Depreciation:

The Internal Revenue Code provides a magic deduction for real estate investors, and that deduction is depreciation. Why is it magic? For every other deduction you actually have to spend money to get it. With depreciation you get a deduction for the entire value of the structure, even on the amount financed.

Typically a rental house is depreciated over 27.5 years, and a commercial property over 39 years. So, if you bought a rent house for $275,000 you would get a magic deduction of $10,000! The beauty of this is that you could have positive income from your rental, but SHOW A LOSS on your tax return. Magic.

The fun doesn’t stop there, however! Using cost segregation, value can be given to the items WITHIN the house that can and should be depreciated at a faster rate. Those items would be the flooring, the cabinetry, wiring, plumbing, appliances, etc. Writing off these items at a faster rate means more deductions in the early years which means your magic deduction gets bigger and your tax savings increase!

That’s the good news. The bad news is if you sell the rental property you would have to recognize all those years of depreciation as income in the year that you sell it and using the cost segregation only makes that taxable “profit” bigger.

But what if you trade it???

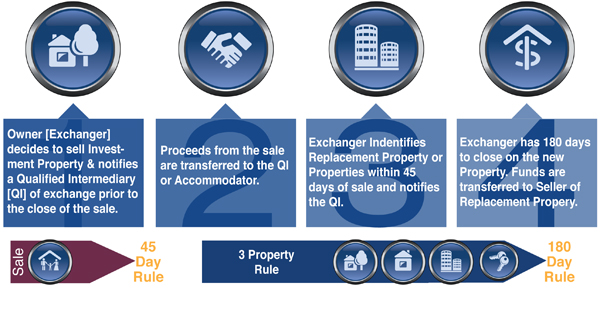

Using an incredible benefit of tax code for real estate investors a landlord can “exchange” their current property for a better one AND RECOGNIZE ZERO PROFIT, MEANING NO TAX!

Here’s how it works:

You can continue to Level UP using this method and can potentially delay tax on profits indefinitely. The Tax Code is written to incentivize those that provide jobs and housing, why not take advantage of those incentives? Schedule an appointment to meet and let us show you how to take advantage of the tax code.

Contact Us

Schedule an Appointment

Oklahoma City

10101 S Pennsylvania Ave. Suite B

Oklahoma City, OK 73159

Edmond

15112 Traditions Blvd. Suite B

Edmond, OK 73013